Board of Directors’ Report

The Board of Directors and the President of Alfa Laval AB (publ) hereby submit their annual report for the year of operation January 1, 2023 to December 31, 2023.

The information in this annual report is such information that Alfa Laval AB (publ) must publish in accordance with the Securities Market Act. The information was made public by publishing the annual report on Alfa Laval’s website on March 28, 2024 at 10.00 CET.

Alfa Laval AB is a public limited liability company. The seat of the Board is in Lund and the company is registered in Sweden under corporate registration number 556587-8054. The visiting address of the head office is Rudeboksvägen 1 in Lund and the postal address is Box 73, 221 00 Lund, Sweden. Alfa Laval’s website is: www.alfalaval.com.

Financial statements

The following parts of the annual report are financial statements: the Board of Directors’ Report, the ten-year overview, the consolidated cash flows, the consolidated comprehensive income, the consolidated financial position, the changes in consolidated equity, the parent company cash flows, the parent company income, the parent company financial position, the changes in parent company equity and the notes. All of these have been audited by the auditors.

The Corporate Governance Report, which also has been reviewed by the auditors, is to be found on page 82.

The statutory sustainability report for the parent company and the consolidated Group, which also has been reviewed by the auditors, is to be found on pages 46–79. Supplementary sustainability notes are to be found on Alfa Laval’s website Alfa Laval – Publications. The supplementary sustainability notes were published on the website at the same time as the annual report.

Ownership and legal structure

Alfa Laval AB (publ) is the parent company of the Alfa Laval Group.

The company had 54,178 (54,346) shareholders on December 31, 2023. The largest owner is Winder Holding AG, Switzerland (formerly Tetra Laval International SA, Switzerland), who owns 29.5 (29.5) percent. Next to the largest owner, there are nine institutional investors with ownership in the range of 7.4 to 1.7 percent. These ten largest shareholders owned 61.3 (63.0) percent of the shares.

Operations

Alfa Laval is a world leader in heat transfer, centrifugal separation and fluid handling, and is active in the areas of Energy, Marine, and Food & Water, offering its expertise, products, and service to a wide range of industries in some 100 countries. The company is committed to optimizing processes, creating responsible growth, and driving progress to support customers in achieving their business goals and sustainability targets. Alfa Laval is engaged in the development, production and sales of products and systems based on three main technologies: separation/filtration, heat transfer and fluid handling.

Alfa Laval’s business is divided into three Business Divisions ”Energy”, ”Food & Water” and ”Marine” that sell to external customers and are responsible for the manufacturing of the products and one division “Operations & Other” covering procurement and logistics as well as corporate overhead and non-core businesses. These four divisions constitute Alfa Laval’s four operating segments.

The customers to the Energy Division purchase products and systems for energy applications, whereas the customers to the Food & Water Division purchase products and systems for food and water applications. The customers to the Marine Division purchase products, systems and digital solutions for marine and offshore applications.

The three Business Divisions are in turn split into a number of Business Units. The Energy Division consists of four Business Units: Brazed & Fusion Bonded Heat Exchangers, Energy Separation, Gasketed Plate Heat Exchangers and Welded Heat Exchangers. The Food & Water Division consists of six Business Units: Decanters, Food Heat Transfer, Food Systems, Hygienic Fluid Handling, High Speed Separators and Desmet. The Marine Division consists of four Business Units: Pumping Systems, Water, Wind & Fuel Solutions, Heat & Gas Systems and Digital Solutions.

Material factors of risk and uncertainty

The main factors of risk and uncertainty facing the Group concern the business cycle, the consequences of Russia’s war on Ukraine and other geo-political tensions, the price development of metals, inflationary pressures, the interest rate development and volatile fluctuations in major currencies. For additional information, see the sections on financial and operational risks and the section on critical accounting principles, the section on key sources of estimation uncertainty and the section on judgements under accounting principles.

Acquisition of businesses

2023

On March 2, 2023, Alfa Laval acquired an additional 38.7 percent of StormGeo’s subsidiary Climatempo in Brazil from the minority owners. Alfa Laval’s ownership thereby increased from 51 percent to 89.7 percent. The transaction is reported as a change within the equity.

In 2021, Alfa Laval acquired a minority stake of 16.5 percent in the Netherland-based company Marine Performance Systems (MPS) with an option to acquire the remaining part later. Now Alfa Laval has executed that option and completed the acquisition to own 100 percent of MPS. The closing date for the acquisition was March 21, 2023. MPS’ innovative technology significantly reduces the friction from vessels when sailing, resulting in fuel savings. Friction between the hull and the water when sailing is the most significant driver of a vessel’s fuel consumption, and the cost of fuel represents up to 60 percent of a vessel’s operating costs. Fuel consumption has a direct impact on greenhouse gas emissions, as reducing 1 ton of fossil fuel consumption equals the reduction of approximately 3 tonnes of CO2 emissions. Marine Performance Systems’ air lubrication technology generates micro bubbles under a ship’s hull, reducing friction between the vessel and the water by 50-70 percent and enabling substantial fuel cost savings and improvement in overall ship efficiency, during normal service speed. The technology was first tested on a sea-going vessel in 2020 and the fuel savings have been confirmed by the shipowner based on several months of operation. The patented solution can be installed on vessels of any size or fuel type at point of building or retrofitted on already operating vessels. Since the acquisition Alfa Laval has launched the Alfa Laval OceanGlide product that creates an even layer of micro air bubbles across the vessel’s flat bottom area, which reduces drag by up to 75 percent. Since Alfa Laval OceanGlide needs few compressors and no large hull penetrations it can be easily installed.

On July 31, 2023 Alfa Laval acquired 100 percent of a European service provider. The company will operate under its own name as an independent channel.

On July 31, 2023 Alfa Laval acquired 51 percent of the Danish company Header-coil Company A/S that develops and manufactures heat

exchangers and steam generation system equipment components based on its header-coil design for the concentrated solar power (CSP) industry, thermal energy storage etc.

2022

On September 13, 2022 Alfa Laval announced that it has acquired BunkerMetric, a Scandinavian software company that develops advanced decision support tools for marine bunker vessels. The acquisition is part of Alfa Laval’s strategy to expand its digital marine service offering and will be part of the recently acquired StormGeo, a global leader in weather intelligence software and decision support services. BunkerMetric, headquartered in Denmark, supports ship operators in finding the best bunker procurement plan and improving voyage margins by using sophisticated algorithms. The optimization tools, together with StormGeo’s advanced route services, will enable ship owners to streamline operations to help them improve their bottom line. BunkerMetric’s procurement optimization tool will become a subscription service within StormGeo’s existing offering.

On August 31, 2022 Alfa Laval announced that it has closed the acquisition of Scanjet, a leading global supplier of tank cleaning equipment and solutions for marine, offshore and industrial applications. The acquisition will extend Alfa Laval’s broad tanker offering, creating a more comprehensive product portfolio for cargo tanks. Scanjet’s intelligent tank management solutions will be a valuable complement to Alfa Laval’s sustainable marine offering as they reduce the water usage and energy consumption connected with tank cleaning. Adding Scanjet to Alfa Laval’s portfolio will support customer efficiency at every stage of cargo handling. Scanjet has global presence with factories in Sweden, Poland and Indonesia.

On August 2, 2022 Alfa Laval announced that it has closed the acquisition of Desmet, part of the Desmet Ballestra Group, a world leader in engineering and supplying processing plants and technologies for edible oils and biofuel sectors. The acquisition will strengthen Alfa Laval’s position in the renewable energy arena and complement its offering within edible oils. Headquartered in Brussels, Belgium, Desmet employs around 1,000 people in Europe, India, Southeast Asia, North America and Latin America. The acquired business was a part of the Desmet Ballestra Group and had a turnover of approximately EUR 300 million in 2021. The operational units and brands of Rosedowns and Stolz are included in the transaction. The Desmet Ballestra Group was owned by Financière DSBG and ultimately controlled by Kartesia and Farallon. The acquisition will operate as a stand-alone entity within the Food & Water Division of Alfa Laval. It strengthens Alfa Laval’s position in the markets for edible oils, biofuels, and plant- and animal-based proteins for food and feed. The acquisition will have a positive impact on earnings per share and be marginally decretive to Alfa Laval’s EBITA margin. “The acquisition will be an excellent fit for our offering of specialized processing equipment designed to increase both yield and quality of customers’ end products,” says Tom Erixon, President and CEO of Alfa Laval. “It will add know-how and expertise to accelerate future innovations within food, feed and biofuels – and strengthen our ability to support the transformation towards renewable fuels.”

Investments in joint ventures and other companies

During 2023 Alfa Laval acquired additional shares in Malta Inc for SEK 50 million (-), whereby the ownership increased from 18.3 percent to 19.2 percent. During 2022 Alfa Laval acquired shares for an additional SEK 13 million in the Swedish company Liquid Wind, which gave a 5.2 percent ownership in the company. The company develops electro-fuel facilities to produce renewable clean fuels.

During 2023 Alfa Laval made a capital contribution of SEK 62 (40) million into AlfaWall Oceanbird, which is a joint venture together with Wallenius to supply innovative wind propulsion solutions for cargo vessels and other ship types. Alfa Laval also made a capital contribution of SEK 1 (-) million into Stadion Laks, which is a joint venture together with the Norwegian fish farming company Lingalaks to develop pumping technology for more sustainable fish farming.

Sale of real estate

During 2023 the property in Eastbourne in the UK has been sold for SEK 71 (15) million with a realised result of SEK 68 (-7) million.

The property in Singapore, the property in Alonte in Italy, the properties in Camberley and Cwmbran in the UK and four smaller properties in India are for sale and are expected to be sold within the next year. These have therefore been classified as current assets held for sale with SEK 59 (100) million. The fair value of the properties for sale exceeds the book value by approximately SEK 373 (246) million.

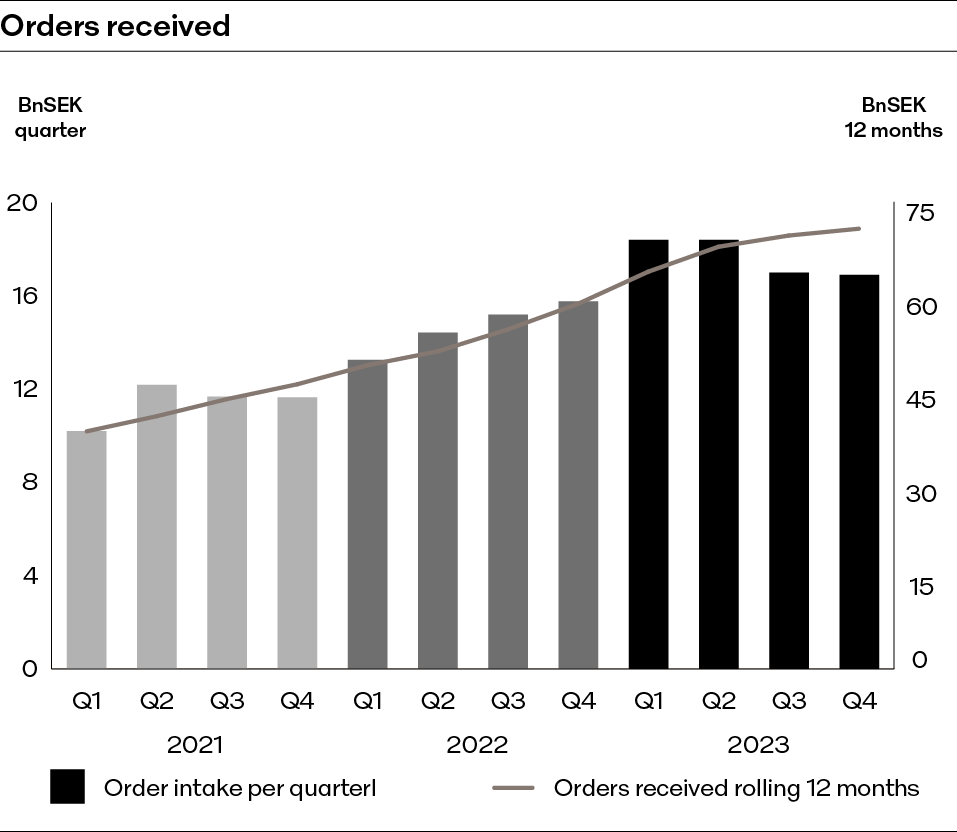

Orders received amounted to SEK 70,742 (58,645) million during 2023.

| Order bridge | ||

| Consolidated | ||

| SEK millions/% | 2023 | 2022 |

| Order intake last year | 58,645 | 45,718 |

| Organic 1) | 10.5% | 14.4% |

| Structural 1) | 6.3% | 3.8% |

| Currency | 3.8% | 10.1% |

| Total | 20.6% | 28.3% |

| Order intake current year | 70,742 | 58,645 |

1) Change excluding currency effects.

Orders received from the aftermarket Service constituted 27.6 (28.4) percent of the Group’s total orders received for 2023.

| Order bridge Service | ||

| Consolidated | ||

| SEK millions/% | 2023 | 2022 |

| Order intake last year | 16,640 | 12,864 |

| Organic 1) | 11.9% | 15.4% |

| Structural 1) | 0.7% | 2.7% |

| Currency | 4.9% | 11.3% |

| Total | 17.5% | 29.4% |

| Order intake current year | 19,551 | 16,640 |

1) Change excluding currency effects.

• Organic: change excluding acquisition/divestment of businesses.

• Structural: acquisition/divestment of businesses.

• Service: Parts and service.

Large orders

Large orders are orders with a value over EUR 5 million. The volume of large orders is an important indicator of the demand situation and is therefore monitored separately within Alfa Laval. A large volume of large orders normally also means a good load in the factories. During 2023 Alfa Laval has received the following large orders:

| Large orders (>EUR 5 million) | |||||

| Division | Order received in | Delivery date | Order amount | Total per Business Unit | |

| Business Unit | 2023 | 2022 | |||

| Scope of supply | SEK millions | ||||

| Energy | |||||

| Welded Heat Exchangers | |||||

| Air coolers for a gas plant in the US. | Q1 | 2023 | 70 |

| |

| Wet surface air cooler for a polypropylene plant in the U.S. | Q2 | 2024 | 143 |

| |

| Spiral heat exchangers for a refinery in India. | Q2 | 2024 | 86 |

| |

| Heat exchangers for an LNG terminal in China. | Q3 | 2024 | 76 |

| |

| Air coolers for propylene condensers to an ethane plant in the U.S. | Q3 | 2024 | 248 | 623 | 224 |

| Energy Separation |

| ||||

| Zero liquid discharge system to a recycling plant in the U.S. | Q4 | 2024 | 71 | 71 | 93 |

| Gasketed Plate Heat Exchangers |

| ||||

| Heat exchangers for a hydrogen plant in the Middle East. | Q1 | 2023 | 63 |

| |

| Heat exchangers for district heating in China. | Q1 | 2023 | 119 |

| |

| Plate heat exchangers for a petrochemical plant in the Middle East. | Q2 | 2023 | 105 |

| |

| Heat exchangers for data centres in the U.S. | Q3 | 2024 | 72 |

| |

| Heat exchangers for a fertilizer plant in Australia. | Q4 | 2024 | 70 | 429 | 313 |

| Food & Water | |||||

| Decanters |

|

| |||

| Ashbrook winkle presses for a sludge processing plant in the U.S. | Q2 | 2026 | 68 | 68 | 78 |

| Food Systems |

|

|

|

| |

| Equipment for a pharmaceutical plant in Malaysia. | Q2 | 2023 | 59 |

| |

| Pre-treatment systems for a bio fuel plant in South Korea. | Q2 | 2024 | 87 |

| |

| Equipment for a juice mixing plant in Denmark. | Q4 | 2025 | 324 |

| |

| Equipment for edible oil processing plant in Mexico. | Q4 | 2025 | 120 |

| |

| Refining equipment for palm oil plant in Nigeria. | Q4 | 2024 | 61 | 651 | 1,284 |

| Desmet |

| ||||

| Equipment for soy bean extraction in the US. | Q1 | 2024 | 208 |

| |

| Equipment for sunflower oil refinery in Kazakhstan. | Q1 | 2024 | 58 |

| |

| Vacuum dryer for a canola oil extraction plant in Australia. | Q2 | 2024 | 85 |

| |

| Steam jet ejector and separator for a biodiesel plant in Indonesia. | Q2 | 2024 | 83 |

| |

| Refining equipment for an oilseed refinery in the U.S. | Q2 | 2024 | 334 |

| |

| Preparation equipment for a soybean and canola seed plant in the U.S. | Q2 | 2024 | 214 |

| |

| Extraction and water degumming equipment for a soybean and canola seed plant in the U.S. | Q2 | 2024 | 146 |

| |

| Pretreatment and refining equipment for a soybean and sunflower refinery in the U.S. | Q2 | 2024 | 159 |

| |

| Equipment for a palm oil fractionation plant in Indonesia. | Q2 | 2024 | 152 |

| |

| Equipment for a palm oil fractionation plant in Indonesia. | Q3 | 2024 | 66 |

| |

| Equipment for a canola pre-pressing plant in Canada. | Q3 | 2025 | 142 |

| |

| Equipment for a canola oil extraction plant in Canada. | Q3 | 2025 | 118 |

| |

| Equipment for a canola oil refinery plant in Canada. | Q3 | 2025 | 208 |

| |

| Pre-treatment equipment for a biodiesel plant in Bolivia. | Q3 | 2024 | 76 |

| |

| HVO pre-treatment equipment for a biofuel plant in Australia. | Q3 | 2024 | 402 |

| |

| HVO pre-treatment equipment for a biofuel plant in Thailand. | Q3 | 2024 | 113 |

| |

| Equipment for a rapeseed pressing plant in Poland. | Q3 | 2023 | 76 |

| |

| Equipment for an oleochemical plant in Indonesia. | Q4 | 2024 | 237 |

| |

| Equipment for an oleochemical plant in Indonesia. | Q4 | 2024 | 244 |

| |

| Equipment for an oleochemical plant in Indonesia. | Q4 | 2024 | 74 |

| |

| Equipment for a rapeseed preparation and extraction plant in Lithuania. | Q4 | 2025 | 176 |

| |

| Refining equipment for a tropical oil refinery in Guatemala. | Q4 | 2025 | 113 |

| |

| Equipment for a vegetable oil refinery in the Netherlands. | Q4 | 2025 | 251 | 3,735 | 350 |

| Large orders (>EUR 5 million), continued | |||||

| Division | Order received in | Delivery date | Order amount | Total per Business Unit | |

| Business Unit | 2023 | 2022 | |||

| Scope of supply | SEK millions | ||||

| Marine | |||||

| Heat & Gas Systems |

|

|

| ||

| Boiler system for a FSRU* in Europe. | Q2 | 2024 | 69 |

| |

| Waste heat recovery and back-up boiler system for a paper mill in Europe. | Q2 | 2024 | 200 |

| |

| Waste heat recovery system for a gas turbine plant in the Caribbean. | Q3 | 2024 | 240 | 509 | 219 |

| Pumping Systems |

| ||||

| Firewater pumps for FPSO** vessels in South America. | Q1 | 2024 | 820 |

| |

| Seawater lift pumps for FPSO** vessel in Australia. | Q1 | 2023 | 135 |

| |

| Firewater pumps for oil platform in Norway. | Q1 | 2024 | 161 |

| |

| Water injection and firewater pumps for oil platform in Norway. | Q1 | 2024 | 218 |

| |

| Cargo oil pumps for FPSO** vessels in South America. | Q1 | 2024 | 393 |

| |

| Sea water lift pumps to an FPSO** vessel outside West Africa. | Q2 | 2024 | 66 |

| |

| Sea water lift pumps to an FPSO** vessel outside South America. | Q2 | 2024 | 62 |

| |

| Cargo pumps to an FPSO** vessel outside South America. | Q2 | 2024 | 123 |

| |

| Fire water pumps for an FPSO** vessel in China. | Q3 | 2024 | 69 |

| |

| Sea water lift pumps for an FPSO** vessel in Singapore. | Q3 | 2025 | 68 |

| |

| Sea water lift pumps for an FPSO** vessel in Singapore. | Q3 | 2024 | 128 |

| |

| Sea water lift pumps for an FPSO** vessel in Singapore. | Q3 | 2024 | 127 |

| |

| Sea water lift pumps for an oil platform in Norway. | Q3 | 2025 | 86 |

| |

| Cargo pumps for an FPSO** vessel in China. | Q3 | 2025 | 185 |

| |

| Suction pump system for an offshore wind farm in Taiwan. | Q4 | 2025 | 277 | 2,918 | 1,326 |

| Total | 9,004 | 3,887 | |||

* Floating Storage Regasification Unit. ** Floating Production, Storage and Offloading.

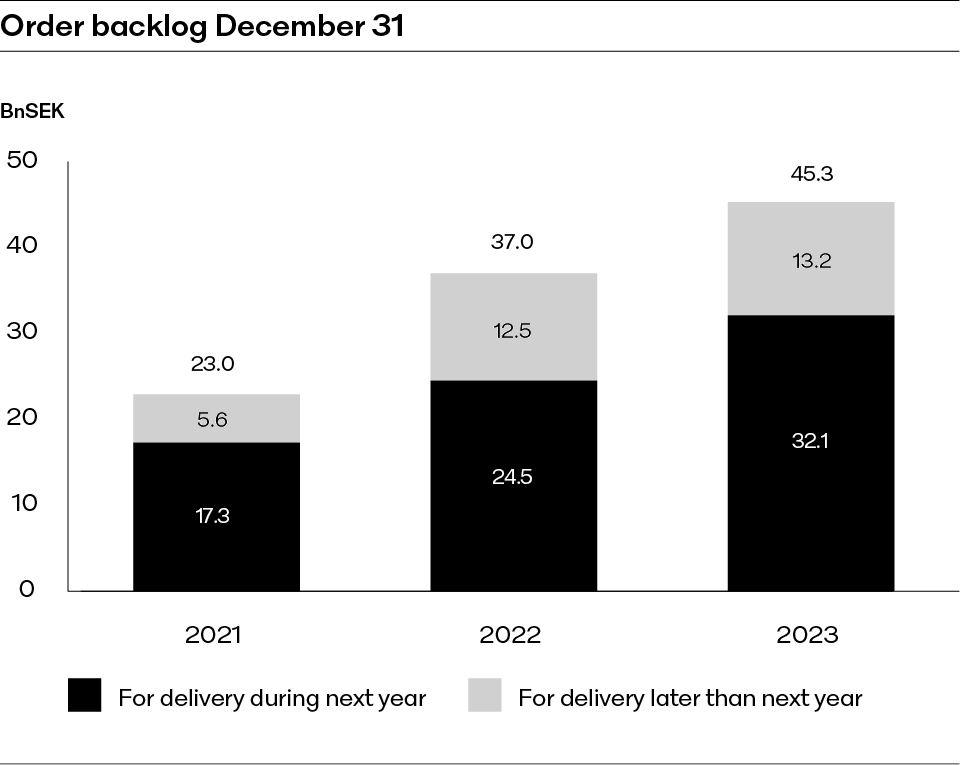

Excluding currency effects and adjusted for acquisition and divestment of businesses the order backlog was 19.0 percent higher than the order backlog at the end of 2022.

Net sales

Net sales amounted to SEK 63,598 (52,135) million during 2023.

| Sales bridge | ||

| Consolidated | ||

| SEK millions/% | 2023 | 2022 |

| Net sales last year | 52,135 | 40,911 |

| Organic 1) | 12.3% | 10.9% |

| Structural 1) | 5.3% | 6.7% |

| Currency | 4.4% | 9.8% |

| Total | 22.0% | 27.4% |

| Net sales current year | 63,598 | 52,135 |

1) Change excluding currency effects.

Net invoicing relating to Service constituted 30.3 (30.0) percent of the Group’s total net invoicing for 2023.

| Sales bridge Service | ||

| Consolidated | ||

| SEK millions/% | 2023 | 2022 |

| Net sales last year | 15,688 | 12,144 |

| Organic 1) | 17.2% | 15.0% |

| Structural 1) | 0.7% | 2.9% |

| Currency | 5.2% | 11.3% |

| Total | 23.1% | 29.2% |

| Net sales current year | 19,308 | 15,688 |

1) Change excluding currency effects.